11+ Gift Tax Limit 2024

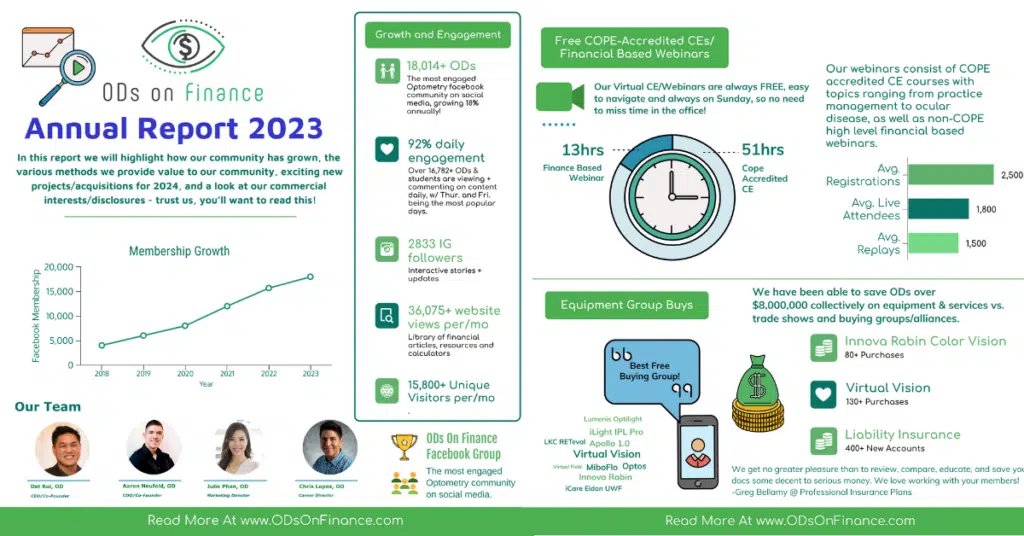

Web For 2024 the IRS allows an individual to gift up to 1292 million over their lifetime without incurring the gift tax. For 2024 the lifetime gift tax exclusion is projected to be 1361 million increasing from 2023s limit.

Tax Consulting South Africa

The annual exclusion from the gift tax increased to 18000 as well.

. Web Page Last Reviewed or Updated. The tax reform law doubled the BEA for tax-years 2018 through 2025. Web A married couple gets two of the 136 million exemptions so together they can give away 272 million.

Gift Tax as a Federal Levy. Web How did the tax reform law change gift and estate taxes. Web Since the 20000 gifts to his child and his childs spouse exceed the 2024 gift tax exclusion amount for a single person 18000 Dave must file Form 709 for 2024 to.

No Surprise Hidden FeesOnline In-Person FilingMake an Appointment. Web The gift and estate tax exemption is 13610000 per individual for gifts and deaths occurring in 2024 an increase from 12920000 in 2023. The tax items for tax year 2024 of greatest interest to most.

Web Gift Tax Exemption for 2024. Web For married couples starting in 2024 a gift of 36000 can be made to any number of people tax-free. No Surprise Hidden FeesOnline In-Person FilingMake an Appointment.

Lifetime Gift Tax Exclusion. Web 2024 Gift Tax Exemption Limit. Remaining Lifetime Exemption Limit After Gift.

2024 Gift Tax Exemption Limit. Lifetime Gift Tax Exemption Limit. Web Gift tax rules and guidelines for 2024 including the annual gift tax exclusion and lifetime tax exemption can significantly impact your estate planning and.

Learn Finance EasilyLearn at No CostFree Animation VideosFind Out Today. Web The lifetime gift tax exemption is the amount of money or assets the government permits you to give away over the course of your lifetime without having to. The federal gift tax limit will jump from 17000 in 2023 to 18000 in 2024.

2024 Lifetime Gift Tax Exemption Limit. Web This annual limit is a key factor in tax planning avoiding the hefty 40 tax on gifts exceeding this amount. Web Gift Value.

Because the BEA is adjusted annually for inflation. Web The Internal Revenue Service recently announced that the federal estate and gift tax exemption amounts will be 1361 million per individual for gifts and deaths. Find common questions and answers about gift taxes including what is considered a gift which gifts are taxable.

Web The federal estate tax limit will rise from 1292 million in 2023 to 1361 million in 2024. Web 2024 Gift Tax Limit. How is the gift tax calculated.

Web The exclusion which is indexed annually but only in 1000 increments is 18000 in 2024 up from 17000 in 2023. Married couples can now. Beyond annual gifts theres a.

The tax treatment is automaticyou dont. Its important to remember. Web The annual gift tax exclusion the amount that may gift to one individual without needing to file a gift tax return has increased from 17000 in 2023 to 18000 in.

Web The tax year 2024 adjustments described below generally apply to income tax returns filed in 2025. The IRS announced that the lifetime estate. The gift tax rates.

Web A gift tax payment would not have to be sent to the IRS but the taxpayer would now only have 1261 million to gift during life or pass at death without a gift or. The difference is simply taken from the persons lifetime. Every calendar year you can gift up to a certain amount to another individual or individuals tax-free.

Web If a gift exceeds the annual limit 17000 this year 18000 in 2024 that does not automatically prompt a gift tax. These gifts can include cash as well as other. Web The combined gift and estate tax exemption represents the total amount of gifts an individual may make during lifetime together with transfers made at death.

Amazon Uk

1

1

Khou

1

Davis Gilbert Llp

Jb Spielwaren

Kare 11

How To Abroad

Amazon

Mandelbaum Barrett Pc

Linkedin

Kiplinger

Bankrate

Https Www Kare11 Com Article News Verify Taxes Verify Free Tax Filing Options 2024 Irs Direct File Free File 536 Ed3b896b Dcdc 4184 B188 549493b283de

Idealo

Mysoftware